*

ICMR and Helios Launch "Syndicate Statistics", a Definitive Review of Lloyd's Performance

Insurance Capital Markets Research (ICMR) and Helios Underwriting PLC (Helios) today announced the launch of their comprehensive new …

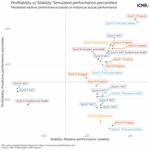

Beyond the Market Cycle: Using AI to Redefine Performance at Lloyd's

Why a shift from absolute metrics to relative benchmarking is key to identifying true outperformers in the Lloyd’s market.

Winning Portfolio Strategies in the Lloyd's Market

Hampden Risk Partners and Insurance Capital Markets Research unveil AI-powered white paper

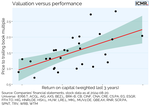

Lloyd’s 2025 Insights Report Highlights Strong Performance and Investor Appeal

Insurance Capital Markets Research (ICMR) and the Lloyd’s Market Association (LMA) have released their 2nd annual report, the Lloyd’s …

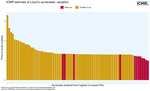

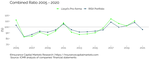

ICMR suggests a sub-90% combined ratio for Lloyd’s based on ‘RISX’

Using the reported data of the RISX index constituents ICMR forecasts Lloyd’s will continue outstanding performance

When Perfect is the enemy of Good

Is the difficulty in launching a new Lloyd’s fund down to focusing on the wrong aspect?

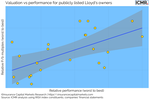

Understanding when listing can be a help or a hindrance

Liquidity versus value creation for listed companies

To M&A, or not to M&A?

Understanding (re)insurance portfolio valuation in real time

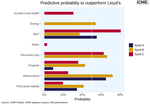

Probability of success at Lloyd’s

How follow only strategies can model data to improve outcomes

The LMA and ICMR release Insights Report on Lloyd’s record-breaking 2023 results

The Lloyd’s Market Association (LMA) and Insurance Capital Markets Research (ICMR) publish a detailed analysis and comment on the …

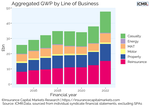

Lloyd's 2023 results exceeds cost of capital

It is the first time in the last decade that Lloyd’s has, in the aggregate, exceeded its estimated weighted average cost of capital …

Review of 2023: Investor appetite returning

Annual returns of the ‘RISX’ equity index of listed companies with Lloyd’s businesses remained strong, and with lower correlation

Asset management: a new frontier in underwriting RoE?

With risk free rates at decade long highs, investment contribution is now a critical component of returns on equity

Gallagher Re and ICMR sign exclusive relationship

Combining deep expertise in reinsurance broking with innovative quantitative analysis

The growing importance of ESG at Lloyd’s

From the novelty of dedicated syndicates to BaU

The best reinsurance underwriters to follow? It’s all in the data

Building a superior follow-only portfolio through class of business performance analysis

Capital markets slowly falling back in love with (re)insurance

ICMR analysis shows (re)insurer P/b’s close to long term highs, but still relatively undervalued

Syndicates relative performance consistency essential in follow-only strategies

As follow-only strategies gain momentum at Lloyd’s, how do you identify consistent gross outperformance?

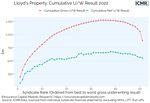

Lloyd’s net underwriting profitability trends disappoint

Line of business performance data from multiple years of individual syndicate reports and accounts, captured and curated by ICMR, …

Lloyd’s result not quite as good as predicted - here’s why

Lloyd’s stated year-on-year rate improvement not reflected in reported loss ratios

ICMR suggests a sub-90% combined ratio for Lloyd’s based on ‘RISX’ index

Using the reported data of the RISX index constituents ICMR forecasts Lloyd’s will report best underwriting result since 2014

RISX equity index surge over the last quarter benefits proven leaders

Successful leaders and smart follow-onlys likely to benefit at the expense of a middle market squeeze

Lead versus follow in ownership of syndicates

Are follow-only strategies a smart alternative to the model of value through verticalisation?

To lead, or to follow ... that is the question!

Successful follow-only strategies can create more value than those of traditional leadership roles

Hedging tail risks through capital markets

Enhance solvency using swaps to take advantage immediately post-event

Lloyd’s syndicates as an investment market

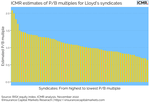

ICMR’s mark-to-model valuation for Lloyd’s investments

Why brand-building is essential to growth

New research analysis conducted by Gracechurch and ICMR shows that leading insurance CEO’s should now treat brand development as …

Insurance cycle has opened a window of opportunity for investments in Lloyd’s

To assess whether investments in Lloyd’s are worthwhile, investors’ expected returns must be compared against the weighted average cost …

What is the value of Lloyd’s and how does it change daily?

Those two simple questions motivated our research into how capital markets data could be used to provide answers on Lloyd’s valuation …

When Private Equity met Lloyd’s

It’s all about enhancing performance and timing the exit

Has Lloyd’s finally conquered expenses?

Specialty (re)insurance is a difficult business to scale

Premiums trumps profitability for underwriters’ emoluments

A successful Lloyd’s underwriter is a good sales person first and foremost

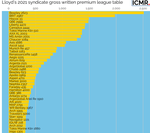

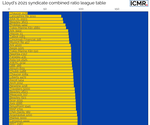

Lloyd's 2021 combined ratio league table

Over 2/3 of Lloyd’s syndicates reported an underwriting profit

The tide may have turned at Lloyd’s, but headwinds remain strong

First look at Lloyd’s 2021 results

‘RISX’ index points to a Lloyd’s combined ratio for 2021 in the low 90s

ICMR’s estimate is based on the aggregated combined ratio of the RISX equity index constituents.

Specialty (re)insurance M&A - price to book multiple trends

RISX index suggests tidy return for Ascot’s investors

Positive earnings for 2021 priced-in despite major cat losses thus far

What do capital markets tell us about premium rate change for the global specialty (re)insurance industry?

RISX Index: more than just a benchmark

This article outlines some of the drivers behind the creation of the RISX index

Press release: ICMR launches RISX Index with Moorgate Benchmarks

ICMR launches innovative new ‘(re)insurance specialty equity index’ and selects Moorgate Benchmarks as its administrator

Third party capital vs building value: revolution or déjà vu?

With improving performance and an expanding range of options for investing, now may well be the best time for some while to be an …

Signs of a turning tide at Lloyd's

Despite of another loss making year at Lloyd’s, signs of a hardening market are becoming visible

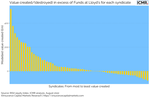

Value creation at Lloyd's: It's not all about the Underwriting Room

The market is buoyant about near term underwriting conditions, but just how important are they to cross-cycle value creation compared …

17 years of Lloyd's Performance Management

Was it worth it? Time will tell.

The Lloyd's 2021 $15bn stakes

ICMR.Matrix; a new tool to assess which syndicates are best placed to win the race for more new business

The reserving cycle and how to avoid it

The Casualty Actuarial Society publishes reserving paper using probabilistic programming

A new metric to assess the insurance cycle?

Research by ICMR shows that comparing stock performance of specialty re/insurance companies with the S&P 500 can provide new …

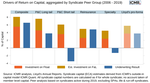

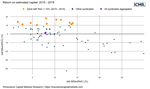

Lloyd’s return on capital: the good, the bad and the ugly

For the first time investors can review Lloyd’s syndicates’ return on capital and compare them directly with other re/insurers.

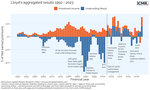

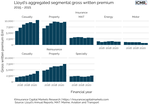

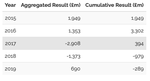

Follow the money: Lloyd's cumulative P&L over the last 20 years

Lloyd’s wrote £448bn of gross premiums since 2000, incurring gross claims to policyholders of £288bn, delivering a net combined …

Performance transition frequencies at Lloyd's

Maintaining performance is one thing, improving performance is a lot more challenging

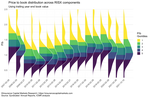

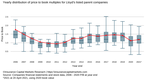

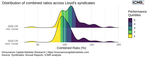

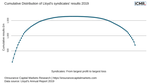

Lloyd's combined ratio performance distribution

Only top quartile and very few second quartile performers achieved underwriting profits in 2019.

Value creation at Lloyd's

Materials from the cancelled joint LMA event 18 March 2020

Review of syndicates' results 2015 - 2019

You don’t have to be big to be successful, but you can get big if you are successful.

Lloyd’s 2019 results by syndicate: Bigger was better

In 2019 there were 110 syndicates, including special purpose arrangements (SPA), of which 105 stated positive GWP, with 56 breaking …

First look at Lloyd's results 2019: The tide hasn't turned yet

Today Lloyd’s released the 2019 pro-forma results for the market stating a profit of £2.5bn. This is a huge improvement to last …

Cancelled: Joint LMA event 18 March 2020

In response to the evolving COVID-19 situation “Value Creation at Lloyd’s” panel discussion will not go ahead on 18 March.

Joint event with LMA on Value Creation at Lloyd's

On 18 March together with the LMA we are organising a panel discussion on the topic of ‘Value Creation at Lloyd’s’

What does value creation mean in the Lloyd’s market?

Introducing the London Insurance Market Index

About Insurance Capital Markets Research

Bridging two industries that, despite their physical proximity, feel worlds apart