Positive earnings for 2021 priced-in despite major cat losses thus far

What do capital markets tell us about premium rate change for the global specialty (re)insurance industry?

As we reach the mid-point of this year’s hurricane season, underwriters and investors are having to price in this year’s catastrophe events and, in some cases, argue the need for even greater rate increases for the industry. Many half-year accounts have asserted a range of rating improvements in the first half of 2021. But what empirical evidence is available to give this some context?

Premium rate change can’t easily be seen directly, given that it comprises underwriter judgement on the financial impact of changing terms & conditions. It can at best be inferred through analysing large enough datasets, but these tend to be retrospective and are usually only available much later than real time.

Can anything be inferred closer to real time? Part of the problem is persuading a large enough group of underwriters, all working for different organisations, to disclose data on a consistent basis. No mean feat. But there is an alternative to underwriters’ subjective views and that is capital markets subjective views. Whilst not the sum of underwriters’ direct observations, it has the advantage of considerably more data points based on considerably more opinions, as well as being in real time.

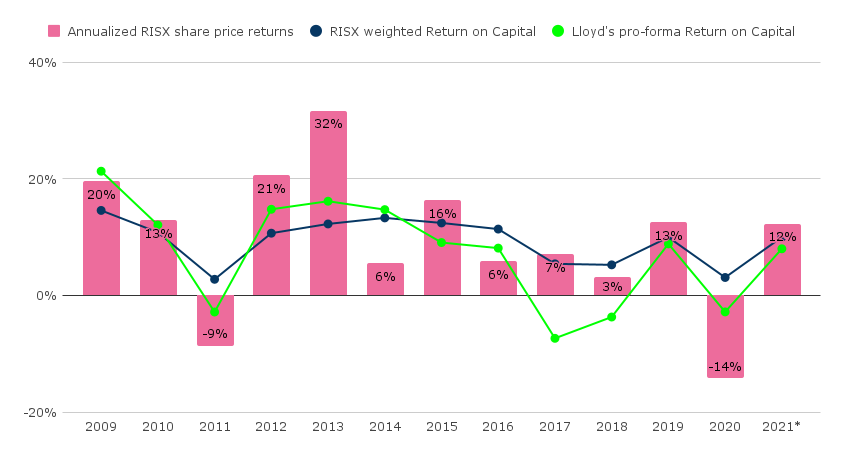

The RISX equity index, based on the stock prices of the listed parent companies of Lloyd’s syndicates, is a capital markets indicator for the global specialty (re)insurance industry and a proxy for Lloyd’s. Over the last 10 years the annualised RISX price returns have been a lead indicator of the annual earning returns. Lloyd’s return on capital is slightly more volatile, given its capital efficiency, but follows the same pattern.

As of 24 September 2021, RISX is showing a year-to-date increase of c.12%, which suggests that capital markets believe the industry will still deliver positive returns for 2021.

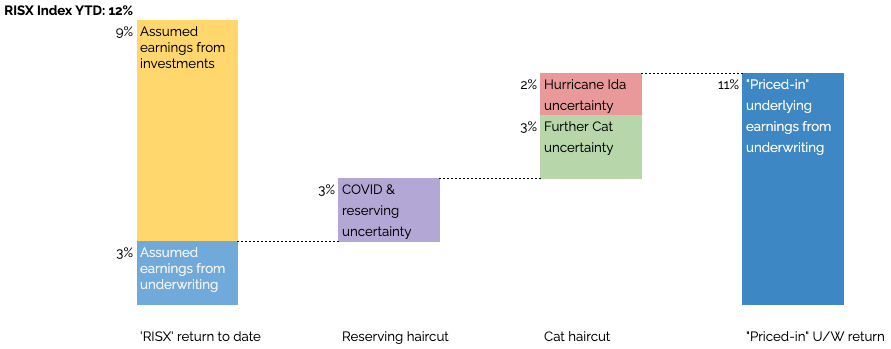

As noted in a previous article, a major part of these earnings will come from investments rather than pure underwriting. Starting from the going-in assumption that 2021’s underlying expected underwriting return on capital should show an improvement over 2020’s underlying, we can then estimate how much additional earnings uncertainty is being priced in. This uncertainty will comprise potential reserve deterioration (especially from COVID) as well as potential further Cat events.

The following return on capital waterfall chart looks at the ICMR estimated component parts to illustrate the point:

The potential impacts from these uncertainties on returns on capital can be estimated from Lloyd’s historical reserving and Cat loss data. Reversing these “priced-in” uncertainties gets closer to capital markets’ views on current underlying year on year underwriting improvement, i.e. through rate change.

Combining the RISX index changes with our forecasts of the amount of priced-in uncertainty suggests an underlying pricing environment that would have generated earnings from underwriting in the range c.11%, which would imply a pricing improvement in excess of 8% (where for Lloyd’s, underwriting capital and net earned premium are substantially similar numbers). And that is an aggregate figure across all business typically written at Lloyd’s.

For more information, please contact us.