‘RISX’ index points to a Lloyd’s combined ratio for 2021 in the low 90s

ICMR’s estimate is based on the aggregated combined ratio of the RISX equity index constituents.

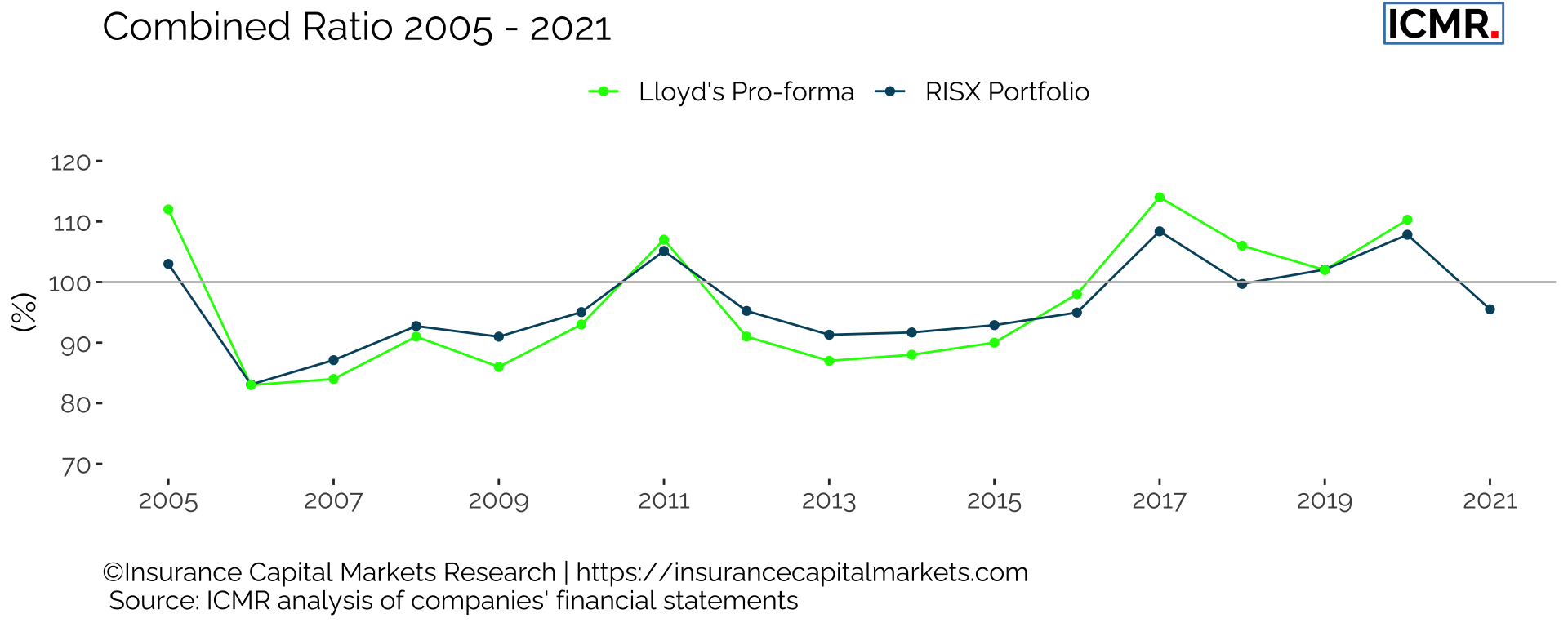

‘RISX’ is the innovative equity index comprising the publicly listed global specialty (re)insurance companies who provide over 80% of Lloyd’s capital, launched by ICMR in May 2021 and maintained by Moorgate Benchmarks, a Morningstar company. Historically, the index combined ratio has closely matched that reported by Lloyd’s. This arises from its unique weighting methodology which uses premium, not market capitalisation. As the majority of component companies have now reported their 2021 financial statements, a clear picture emerges of their weighted combined ratios:

As can be seen, Lloyd’s combined ratio follows the RISX index weighted combined ratio fairly closely, being slightly better in profitable years and slightly worse in unprofitable years, which can be attributed to Lloyd’s greater volatility. The weighted combined ratio for the RISX index is 95.5%, which points to Lloyd’s 2021 combined ratio likely being in the low 90s. This would represent almost a 20% improvement from 2020 and be indicative of the much improved underwriting environment.