When Private Equity met Lloyd’s

It’s all about enhancing performance and timing the exit

Private Equity’s interest in Lloyd’s comes not just from a desire to access profitable underwriting, but predominantly from the opportunity to benefit from a step change in enterprise value. As we have shown in previous articles, relative underwriting performance is relatively stable over time, just like football league tables. We also know that superior performance is often rewarded by improvement in valuation; but by how much?

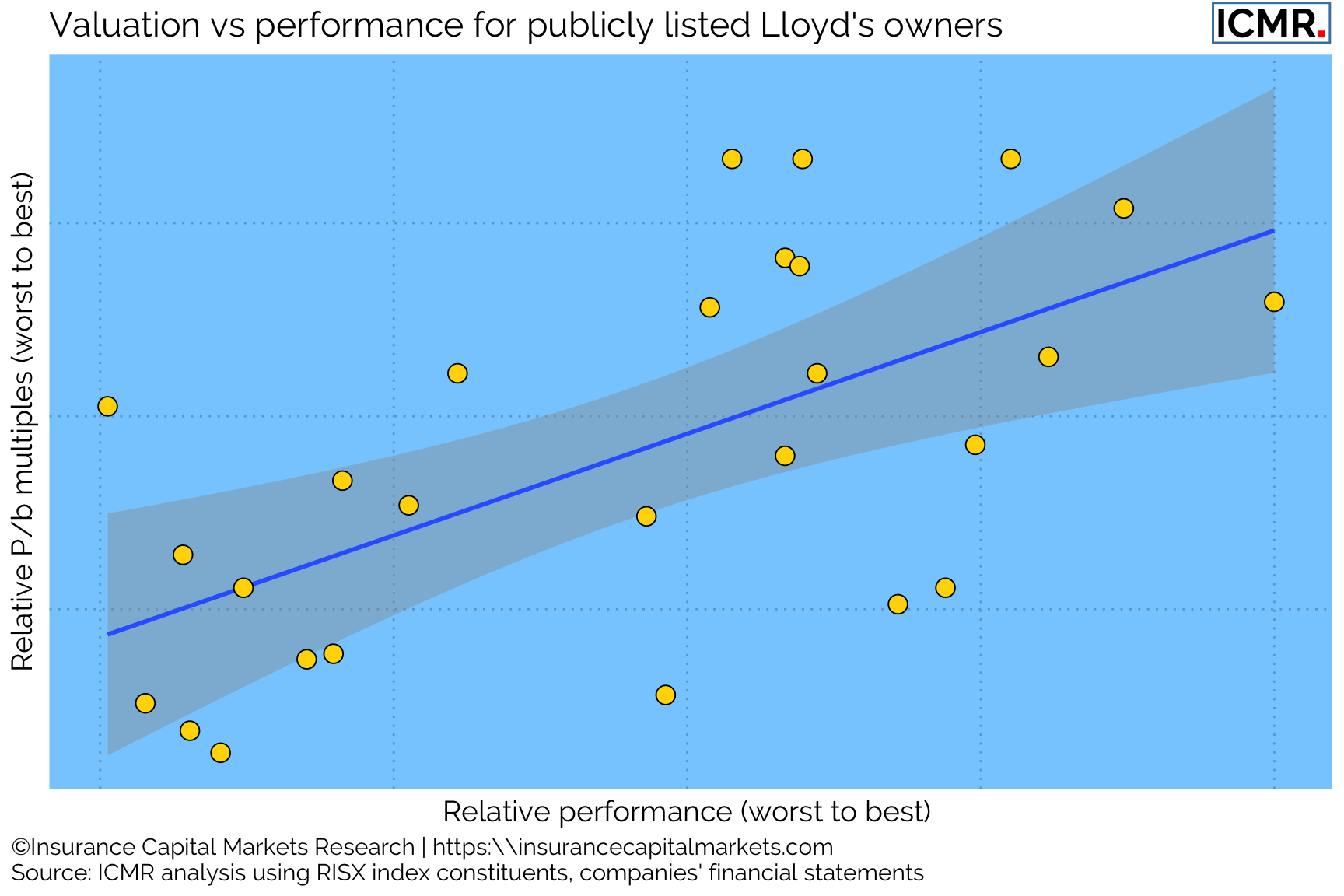

Figure 1: Price to book multiples distribution of publicly listed global specialty (re)insurance companies with Lloyd's subsidiaries ranked against their ranked average performance 2019 - 2021.

The above chart shows the simple truth as experienced by a basket of global listed (re)insurance companies with Lloyd’s subsidiaries that superior relative performance tends to lead to superior relative price to book (P/b) multiples.

So, it’s simple; improve your relative performance, which encompasses underwriting and capital efficiency, and you become more valuable? Well, yes, to a large extent, but there are also some subtleties at play. The key point is ‘relative’ price to book multiples, and these are subject to market forces and cyclicality. Indeed, what the above scatter plot hides, is the fact that top performance in one year can have a very different P/b multiple compared to another year. Hence, monitoring the P/b multiple sentiment over time provides insight about timing the exit.

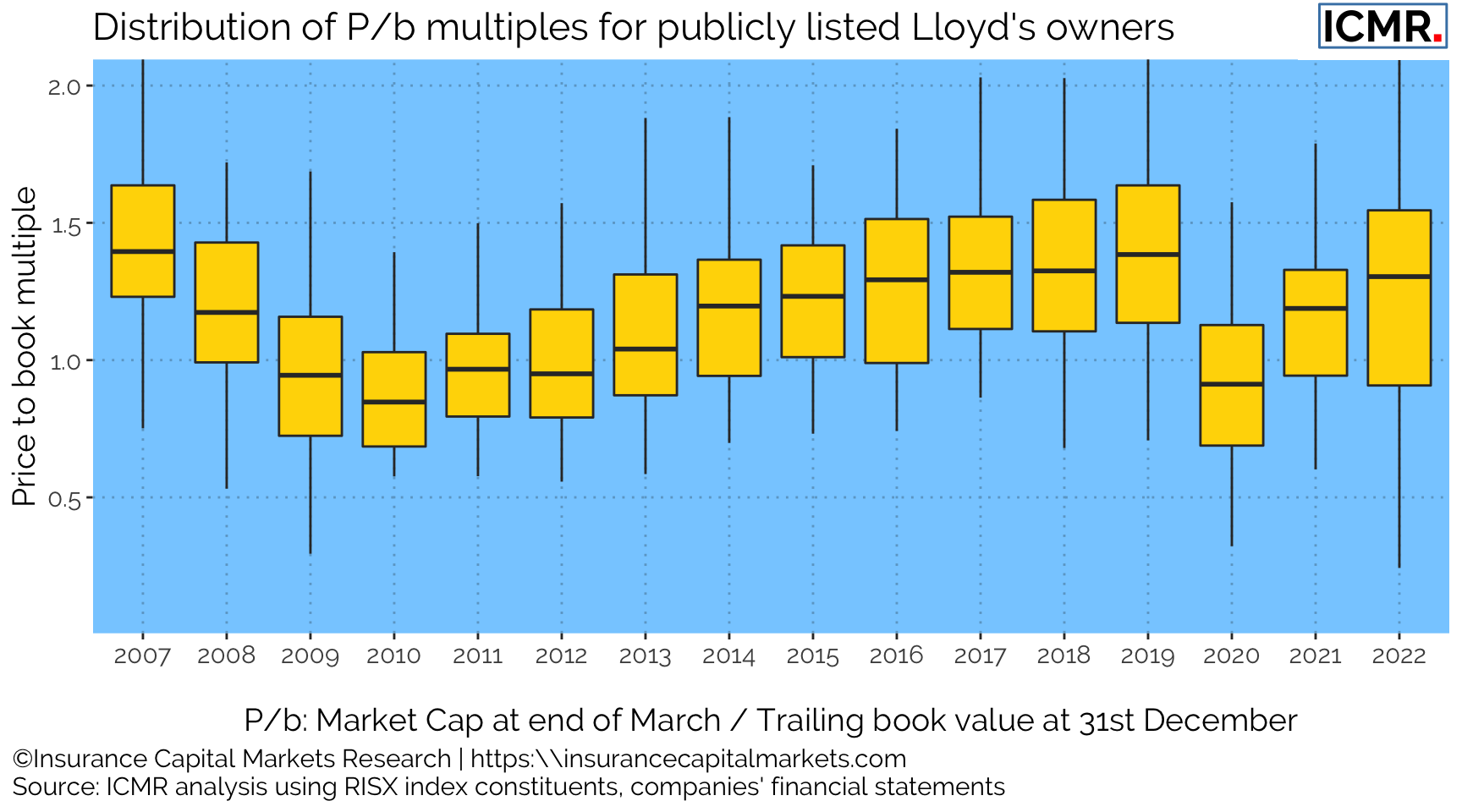

Figure 2: Price to book multiples of publicly listed global specialty (re)insurance companies with Lloyd's business. P/b multiple measured at end of March in each year against the companies' trailing book value.

This chart (again based on ICMR’s historical and real time company pricing information of listed companies with Lloyd’s subsidiaries) shows the range of those global listed (re)insurance companies’ prices to trailing book multiples as at successive year ends. The box whisker plot clearly demonstrates how the quartiles move around over time and how a top quartile valuation can still have a very different multiple dependent on when in the cycle the value is determined.

Which brings us back to Private Equity and their interest in Lloyd’s. Lloyd’s offers a fantastic opportunity not just to access high quality risk but also to grow a syndicate, a franchise, over time. The larger an underwriting franchise becomes, the closer it will tend to average performance, and therefore potentially the more difficult it will be for it to achieve superior valuation. However, for investors, it’s the total return that matters and a £1bn underwriting franchise at a multiple of 1.5x is worth a lot more than one of £250m at a multiple of 2x.

Growth through capital efficient diversification (making sure not to diversify oneself into trouble) and getting the cyclical timing right makes for very attractive returns. Almost makes one want to have what they’re having!

For more information on ICMR’s view on syndicates’ performance, capital and valuation, please contact us.