Lloyd’s syndicates as an investment market

ICMR’s mark-to-model valuation for Lloyd’s investments

The Lloyd’s market appears buoyant with many syndicates aiming to grow their footprint by double digits in 2023. At ICMR we believe that the next few years should see Lloyd’s returns exceeding their cost of capital again. As a result, we expect more M&A activity as investors look to take advantage of increasing value of insurance franchises with improving underwriting performance.

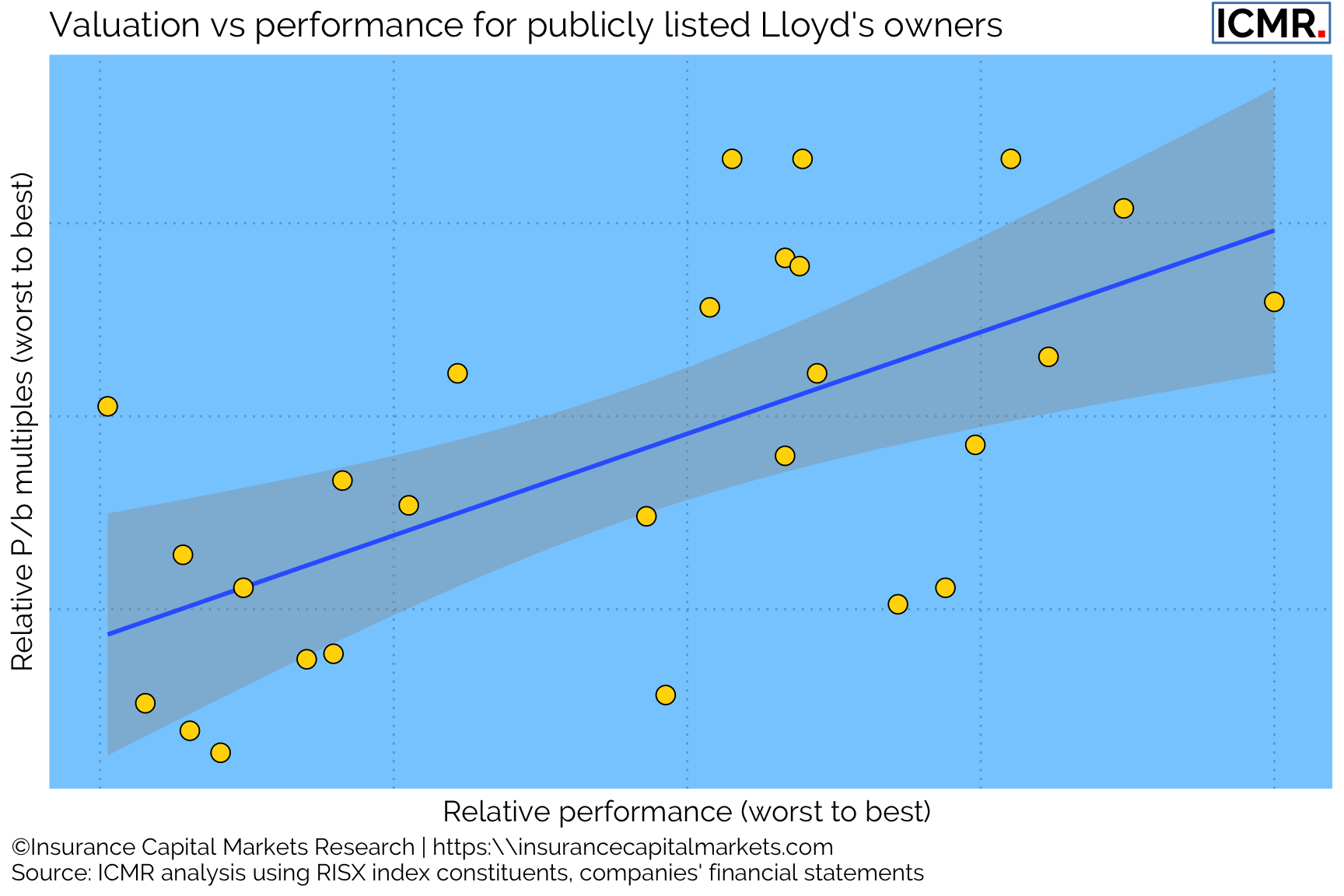

The traditional pricing metric in our industry is the price to book multiple (P/b). The following chart shows the long-term trend of P/b versus performance, using that RISX constituency of listed global property & casualty (re)insurers.

Figure 1: Price to book multiples distribution of publicly listed global specialty (re)insurance companies with Lloyd's subsidiaries ranked against their ranked average performance 2019 - 2021.

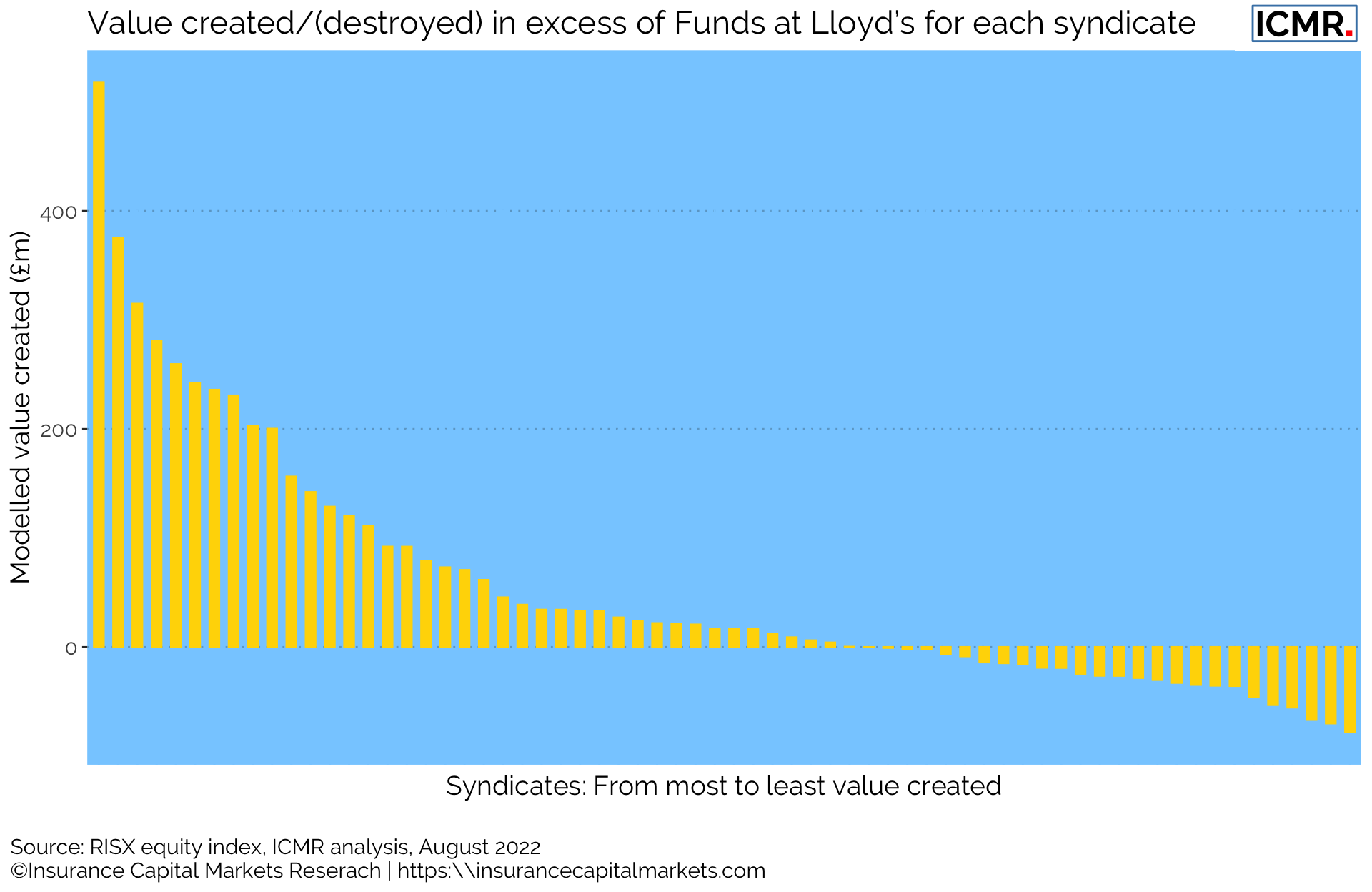

Using the relationship between relative performance and relative P/b multiples within the confidence interval shown above, it is possible to extrapolate a valuation map for every Lloyd’s syndicate. The next chart illustrates every syndicate at Lloyd’s ranked by amount of value created, or destroyed, for their investors. A number of assumptions have been made (listed beneath the chart) but it does serve to underline how Lloyd’s is home to such a wide variety of underwriting performance and therefore value propositions for investors.

Figure 2: ICMR uses a mark-to-model to provide daily valuation of Lloyd’s syndicates, derived from the RISX equity index and its constituents’ trailing balance sheet data, ICMR’s outside-in view on syndicates’ capital and trailing syndicate performance data. Each syndicate is modelled as if it were a fully aligned entity with one capital provider.

Clearly this is only an outside-in view and investors’ actual return expectations will be influenced by a significant number of factors which cannot readily be modelled. But, it does demonstrate how careful investors new to the market must be. Relative performance is particularly stable, meaning underperforming syndicates tend to stay underperforming even in good times. At this time of elevated M&A activity in the sector, new investors need to be confident they are not buying into a business in need of major restructuring, rather than simply development capital.

This article was also published as a Viewpoint during the Monte-Carlo Rendezvous by The Insurer.