RISX equity index surge over the last quarter benefits proven leaders

Successful leaders and smart follow-onlys likely to benefit at the expense of a middle market squeeze

With much mention in the media of a challenging 1.1 renewal period, the logical conclusion is of an appetite mismatch between the coverage reassureds want and the types of risk capital now finds unattractive. The causes of this range from recent experience (Cat losses and consequent trapped capital) to innate caution as economies enter recession, with the attendant fear of increasing moral hazard claims.

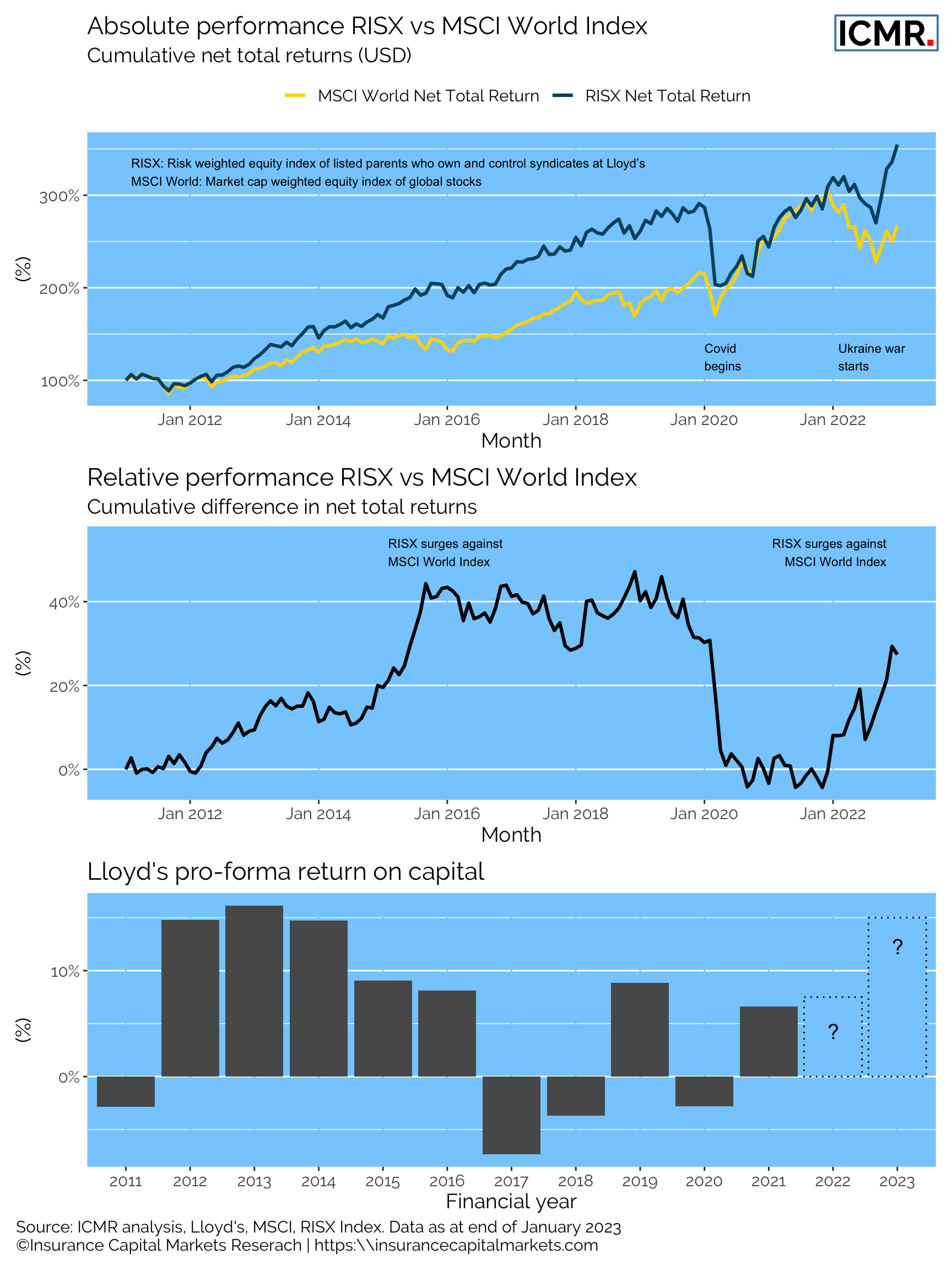

Yet alongside this entirely reasonable caution and withdrawal from certain specialty and reinsurance lines, we have seen a surge in both the absolute and the relative value of the RISX equity index. This index is risk weighted and comprises the listed parent companies who own and control syndicates at Lloyd’s to provide an ‘as-if’ share price for Lloyd’s. The following graphs show RISX performance absolute and relative to the MSCI World Index alongside the Lloyd’s market reported pro-forma returns on capital:

The last time the specialty (re)insurers’ share prices surged relative to the MSCI world index was in 2015, when capital markets began giving credit for sustained industry returns on capital, illustrated by the high teens returns reported for the Lloyd’s market as a whole. Capital, particularly alternative capital, flowed freely into the industry, contributing to suppressed improvements in rate adequacy. This time, investors appear much more discerning in where their capital is deployed.

The announcements of recent specific ILS issues and sidecars suggests capital markets’ risk appetite remains strong but there is a flight to quality with only proven underwriters and managers being entrusted with new capital. This should benefit proven successful leaders and also the smart follow-onlys. It may, however, continue to squeeze those in the middle who cannot differentiate themselves better.

This article was also published as a Viewpoint by The Insurer.