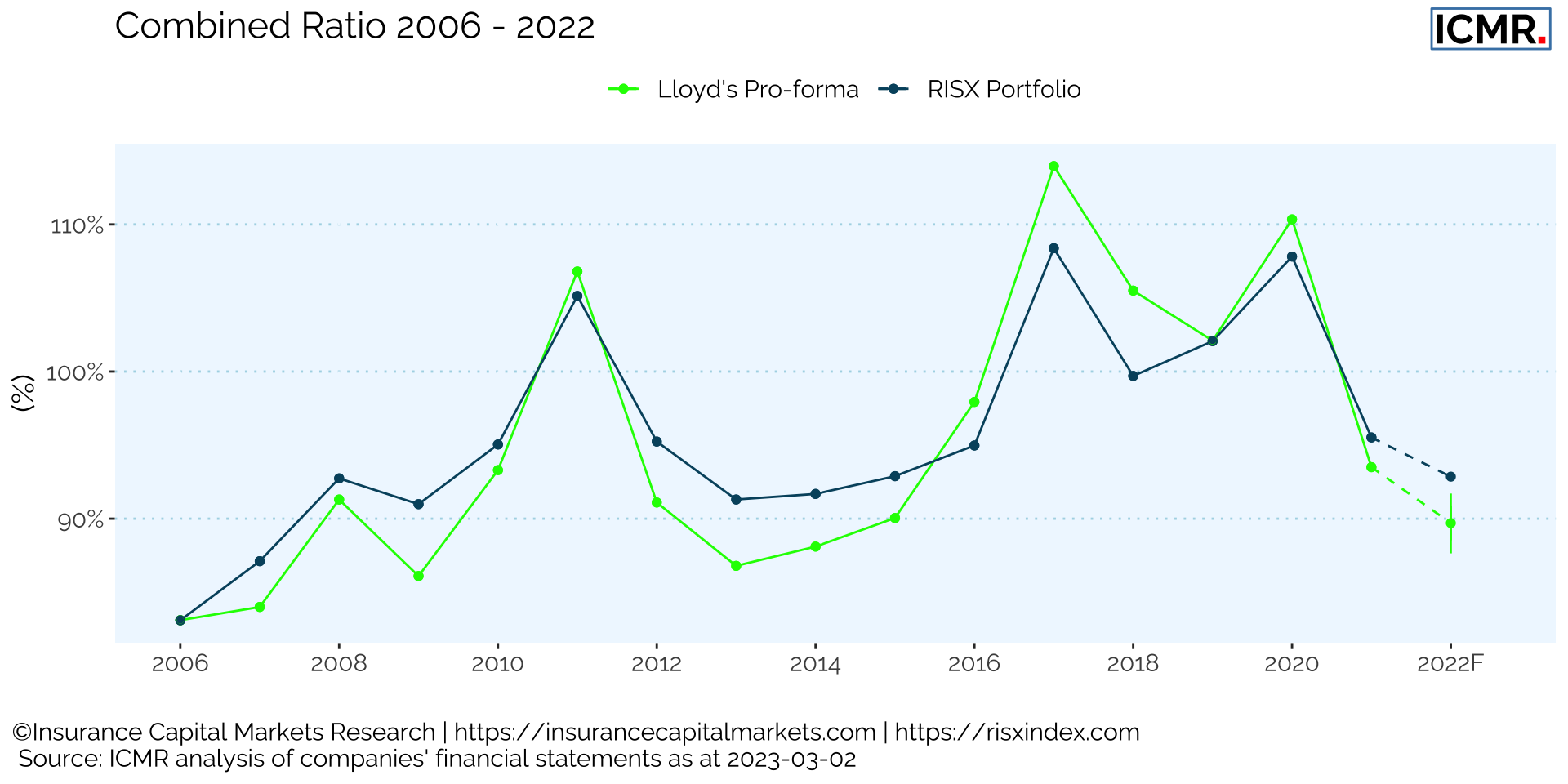

ICMR suggests a sub-90% combined ratio for Lloyd’s based on ‘RISX’ index

Using the reported data of the RISX index constituents ICMR forecasts Lloyd’s will report best underwriting result since 2014

The ‘RISX’ equity index has always been a good benchmark for investing at Lloyd’s. But it is also a good lead indicator of Lloyd’s pro-forma annual accounting performance, through accumulating underwriting data from the component companies’ 2022 financial statements.

The RISX index comprises the publicly listed global specialty (re)insurance companies who provide most of Lloyd’s capital and uses premium, not market capitalisation, to weight components. One advantage of this is that these companies report some time before Lloyd’s announces its result, giving early insight into the likely performance of the market.

ICMR’s central forecast for Lloyd’s is a combined ratio below 90%. This would be Lloyd’s best underwriting results since 2014, when it reported a combined ratio of 88.1%.

Figure 1: Lloyd's 2022 forecasted combined ratio shown with 50% credible interval.

Historically, Lloyd’s combined ratio follows the RISX index weighted combined ratio closely, being slightly better in profitable years and slightly worse in unprofitable years, which can be attributed to Lloyd’s slightly greater overall volatility.

The combined ratio for the RISX index portfolio is currently predicted at 93%. This points to Lloyd’s 2022 combined ratio likely being below 90%. This would continue the improvement observed last year with a reduction to the low 90s and reflects the much improved underwriting environment. It is also a reflection of central decision making at Lloyd’s over who they allow into the market and who they allow to grow their businesses.

The Corporation is expected to release 2022 full-year results on 23 March.

Methodology

Lloyd’s Pro-forma 2022 combined ratio forecast

The Lloyd’s 2022 forecast is based on a Bayesian regression model using the historical RISX portfolio and Lloyd’s pro-forma combined ratios.

As of 3 March 2023 the aggregated RISX portfolio combined ratio for 2022 reflects 78% of the weights, with with two European companies (Hiscox and Hannover Re) reporting their results next week and all Asian companies in late April/May.

RISX Portfolio

The RISX equity index is a benchmark for investing in Lloyd’s. It is a premium weighted, not market capitalisation weighted, equity index based on the listed companies that participate in Lloyd’s.

The weights are derived from net written premiums disclosed in the syndicates’ financial statements and those of their parent firms. The weights are the geometric mean of the premium share of each syndicate compared to its parent and Lloyd’s, together with the premium share of the parent to its peers.

RISX portfolio combined ratios are the weighted aggregated reported combined ratios of the index constituents. The close match with Lloyd’s pro-forma combined ratio, demonstrates that RISX mimics the market’s risk profile and hence, is a reasonable proxy and investment benchmark for the Lloyd’s market.

The innovative weighting methodology of RISX, using premium rather than market capitalisation, ensures the index correlates more with Lloyd’s risk profile than wider equity markets.

For more information about RISX, its constituents and performance, including factsheet, visit risxindex.com.