The best reinsurance underwriters to follow? It’s all in the data

Building a superior follow-only portfolio through class of business performance analysis

New data and research from ICMR gives a clearer picture of underwriting performance at Lloyd’s by line of business, using data curated by ICMR and unavailable from any other source.

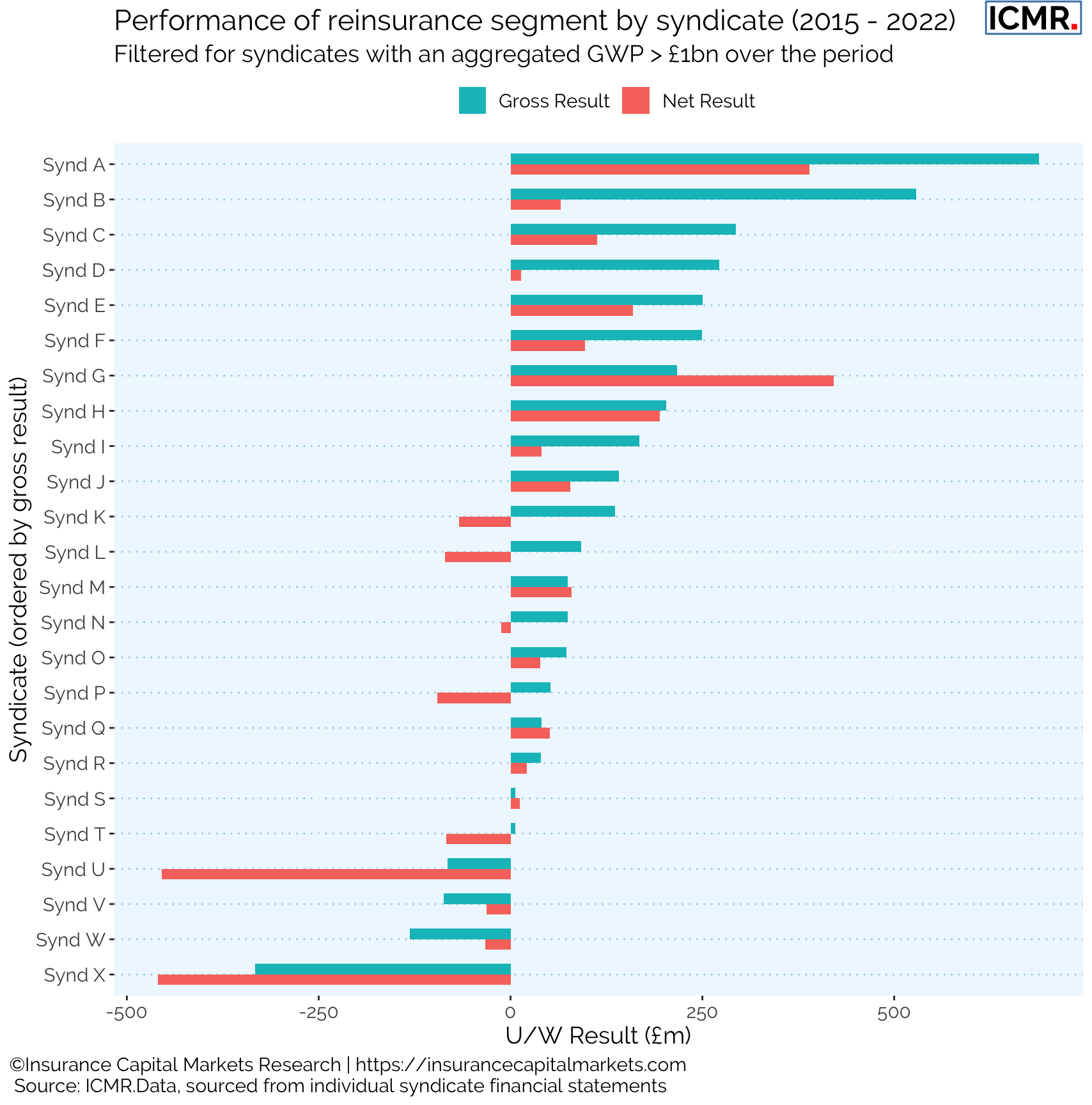

The aggregate performance of Lloyd’s by class of business hides a very diverse range of individual syndicate strategies and outcomes, both on a gross and a net basis.

For follow-only underwriters understanding syndicates’ gross relative performance is critical, and requires access to data harvested from individual syndicate financial statements going back many years.

Reinsurance has been Lloyd’s most profitable class on a gross basis over the last 8 years (representing approximately one full underwriting cycle). However, the difference between syndicates’ gross reinsurance result and their net reinsurance result suggests significant cross-cycle earnings are being given away willingly.

The reasons for this could be many (eg, intra-group reinsurance, LPT transactions or significant use of 3rd party capital) so that is why the analysis is looking at the market across the cycle rather than just at more recent individual calendar years.

This gross to net performance differential could be driven by capital providers’ reducing risk appetite in the sector, making them more comfortable paying away earnings in order to reduce their capital at risk. It could equally be a symptom of some form of disconnect between inwards underwriting and central reinsurance purchasing. Either way, it is not driven by a single calendar year or event but permeates multiple years of underwriting.

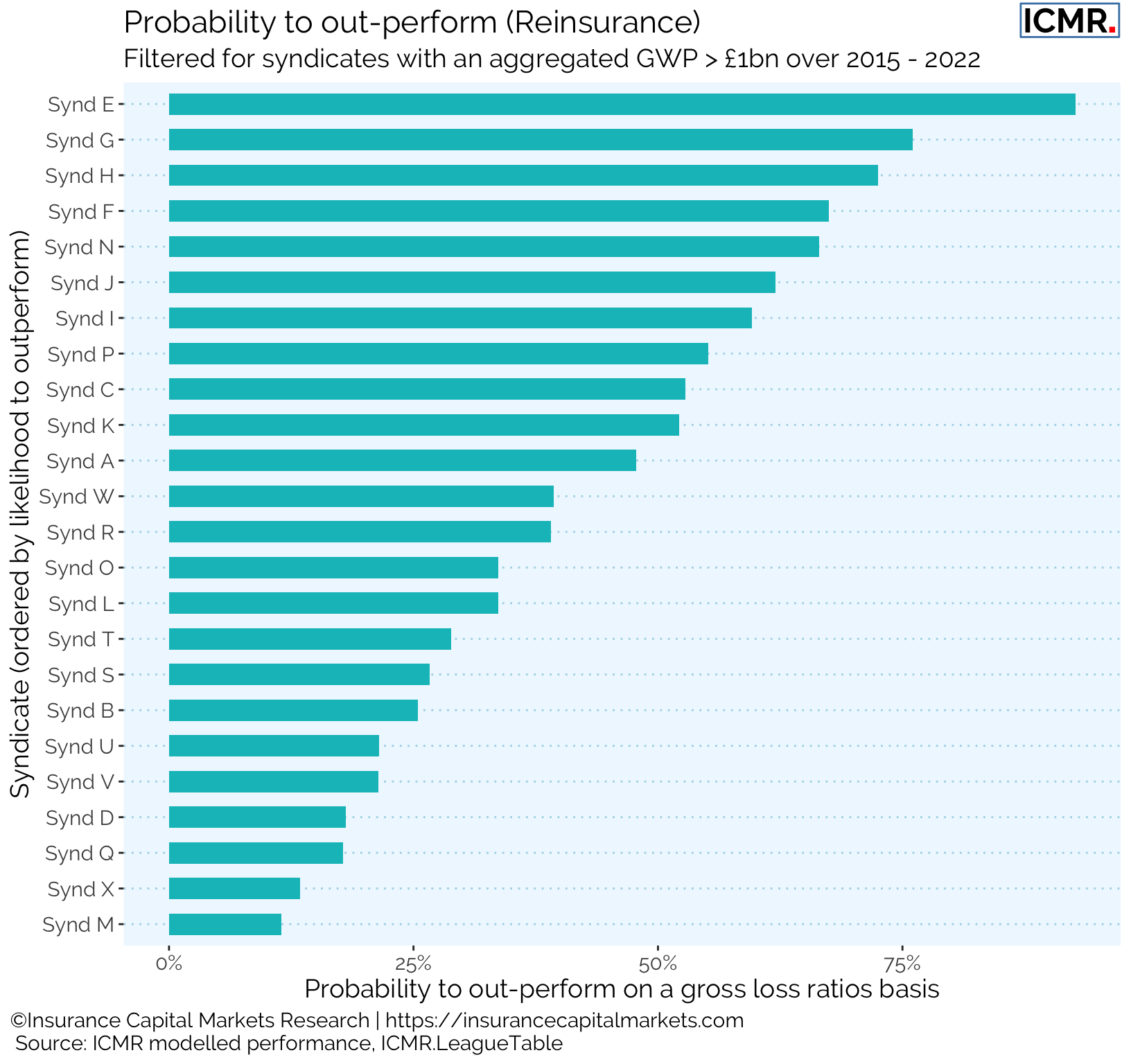

Follow-only strategies will tend only to focus their analysis on gross underwriting, leading to their own questions of how best to purchase reinsurance protection. Given the consistency of syndicates’ relative performance, ICMR developed a model that assess syndicates’ probability of outperforming the market for prospective periods. The chart below does just this:

Certain syndicates are significantly more likely to outperform than others, based on ICMR’s Bayesian rank performance model, which should be a useful input for follow-only strategy planning. What the data and model highlight as well is that successful cycle management is also about when to expand the business, as illustrated by the fact that the most profitable syndicate over the past 8 years is not predicted to be the most likely to outperform on a gross loss ratio basis next year.

In any event, the data shows not only how consistent gross outperformance is for an inwards reinsurance book but also how much of an impact the outwards reinsurance strategy can have on bottom line profitability. Syndicates will need to ensure that good gross underwriters are sufficiently rewarded even when, across the cycle, the same advantage may not be reflected in net results.

This article was also published as a Viewpoint by The Insurer.