The growing importance of ESG at Lloyd’s

From the novelty of dedicated syndicates to BaU

With publication of Lloyd’s 2023 sustainability report still awaited, there remains quite a lot of activity around ESG within the market, including the Lloyd’s Market Association’s recently launched ESG Academy.

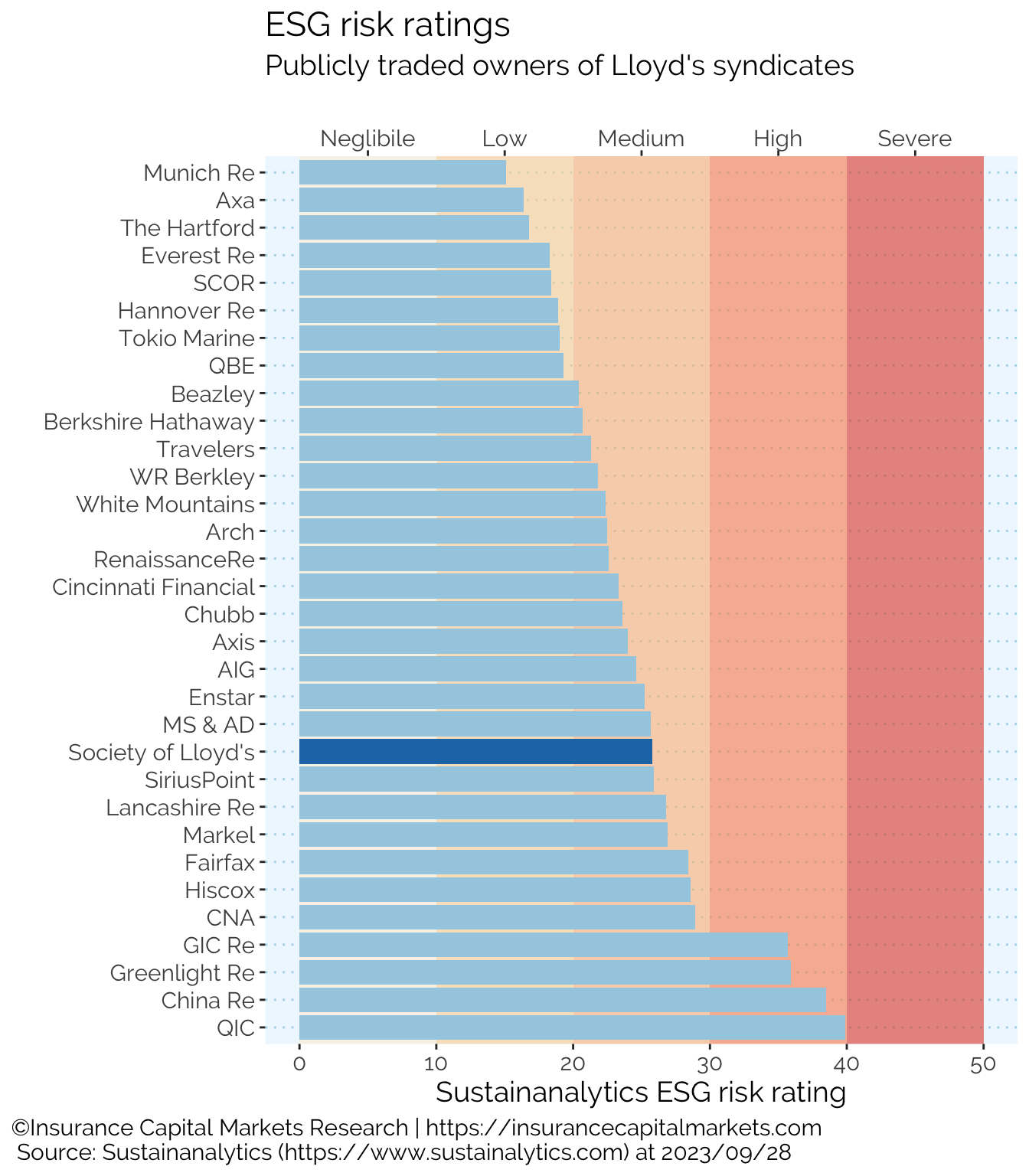

However, most of this is focused on inwards business placed at Lloyd’s, and to a lesser extent the day-to-day operations of the managing agents themselves. To date, little emphasis has been placed on the ESG rating of the owners of Lloyd’s managing agents, most of which are publicly listed and have their own publicly available ESG rating.

As these account for the considerable majority of Lloyd’s capital, this seems an important dimension not to be overlooked.

One could ask, why does this matter? The answer is twofold.

Firstly, placing and accepting client risk is not something undertaken in isolation. If businesses or Lloyd’s only focus on risk sources to evaluate ESG ratings, then neither will truly be embedding ESG within their own “business as usual” operations.

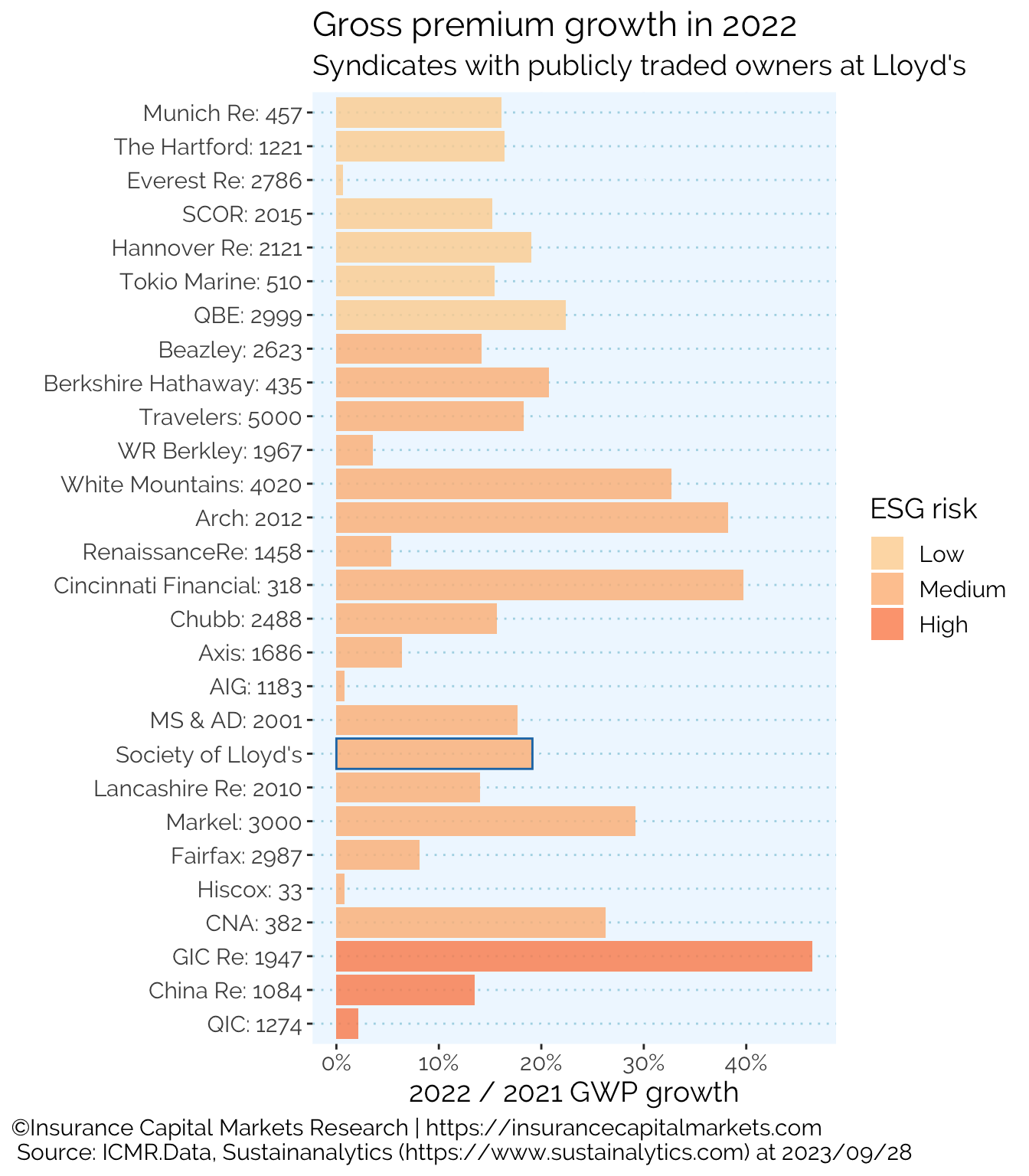

The following chart shows the rates of premium growth Lloyd’s authorised for each of the above companies over the last two years alongside Lloyd’s average for the same period.

The parental ESG rating appears to have little bearing on Lloyd’s authorisation to grow syndicates’ premium footprints, with some of the largest percentage growth being granted to syndicates whose parents have publicly available “high risk” ESG ratings. Given the importance of listed (re)insurance companies to Lloyd’s capital, it does suggest the Corporation’s current hierarchy has yet to develop a holistic approach to ESG across all dimensions of the market.

The second reason for the importance of this topic is the reputational risk. If beneficial behaviours from Lloyd’s propagate within the parent (re)insurer, then that can only be a good outcome.

But the risk remains that an unscrupulous parental (re)insurer could hide their own poor ESG rating behind Lloyd’s and their syndicate’s better rating, to the detriment of the market as a whole.

A holistic approach which took into account not just inward business and managing agent behaviour but also parental ESG rating would quickly and clearly refute any risk of parental ESG underperformers greenwashing their results.

This article was also published as a Viewpoint by The Insurer.