Asset management: a new frontier in underwriting RoE?

With risk free rates at decade long highs, investment contribution is now a critical component of returns on equity

As Warren Buffett once famously wrote, for an insurer that can make underwriting profits over the cycle, that’s the equivalent of the insurer’s shareholders being gifted investment float cost-free. And with the change in investment markets over the last 24 months moving from risk free rates of 1-2% to over 5%, this is becoming a key source of shareholder returns.

The turmoil in investment markets following the financial crisis of 2008 resulted in many insurers outsourcing investment management of their float assets. Much was made at the time of how insurers were underwriting businesses and that investment strategies had no place in determining underwriting strategies. Now, however, we can see just how important investment strategies are to delivering shareholder value. Capital efficiency now has a new dimension: that of investment contribution by class as a consideration in deciding on underwriting portfolio mix.

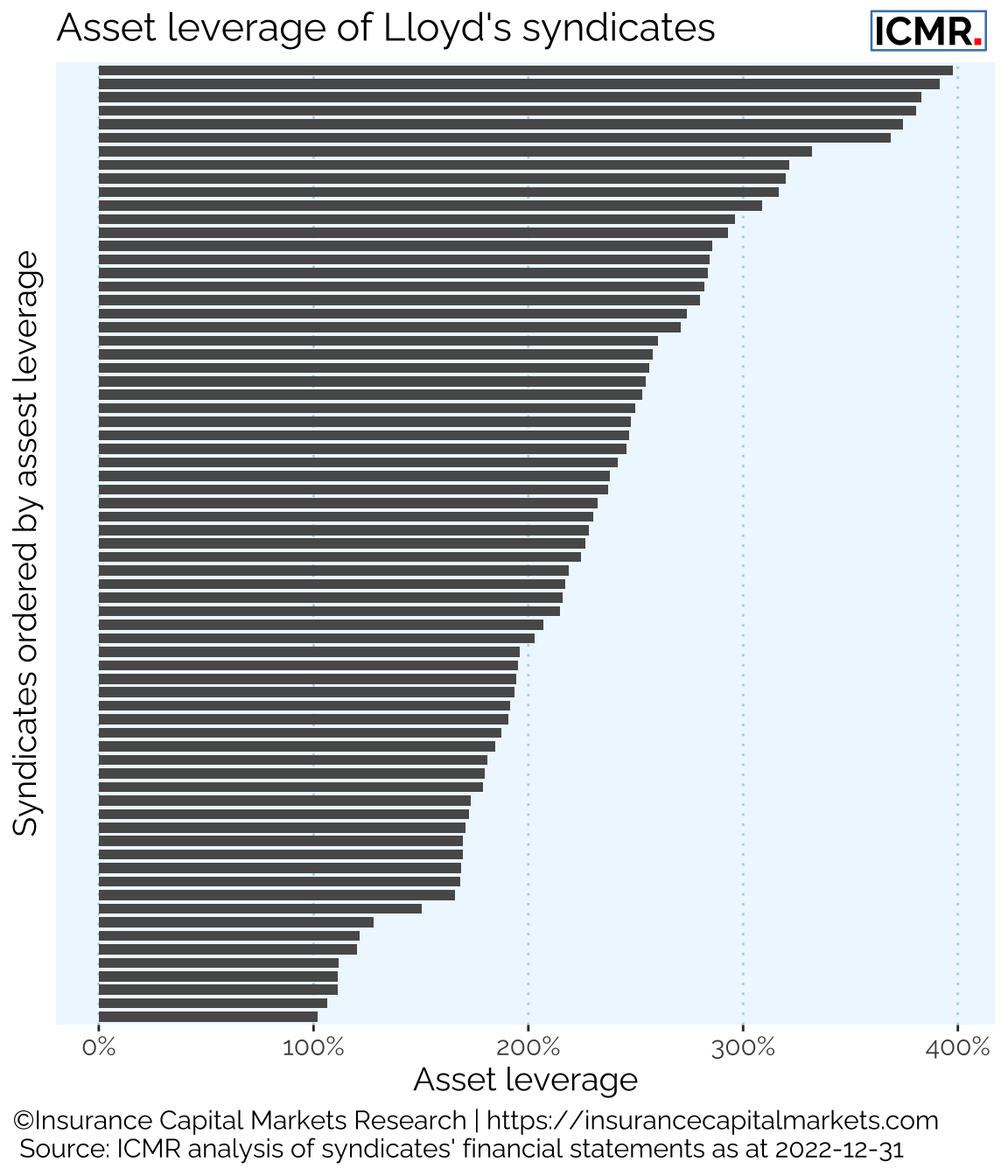

The above chart shows the asset leverage of each syndicate at Lloyd’s. This is each syndicate’s investment float shown as a function of its estimated ECA, as if every syndicate were a single member ILV. The chart shows how significant asset leverage currently is for some syndicates, being up to 4x the value of their estimated ECA, which we can deem to be their effective shareholders’ equity. At current risk free rates of around 5%, that investment return can be worth up to 20% return on equity on its own.

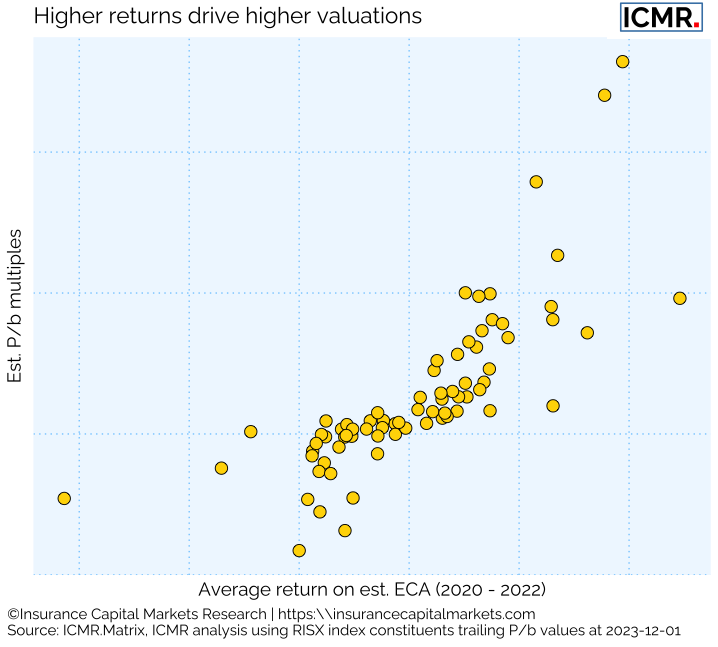

The relationship between returns on equity and valuation is well established:

The above chart plots each syndicate’s estimated price to book multiple against its reported return on equity (based on outside-in modelled ECA) from 2020-2022. The higher the average returns, the higher the estimated P/b multiple.

If you’re in the pack, the ability to outperform peers is advantageous in terms of potential valuation multiple. However, if one can truly differentiate with top quintile outperformance (the right hand side of the chart), maximising shareholder returns across every dimension available to management, the potential valuation rewards are no longer simply linear but can be improved significantly. Something to consider before an IPO.

This article was also published as a Viewpoint by The Insurer.