Review of 2023: Investor appetite returning

Annual returns of the ‘RISX’ equity index of listed companies with Lloyd’s businesses remained strong, and with lower correlation

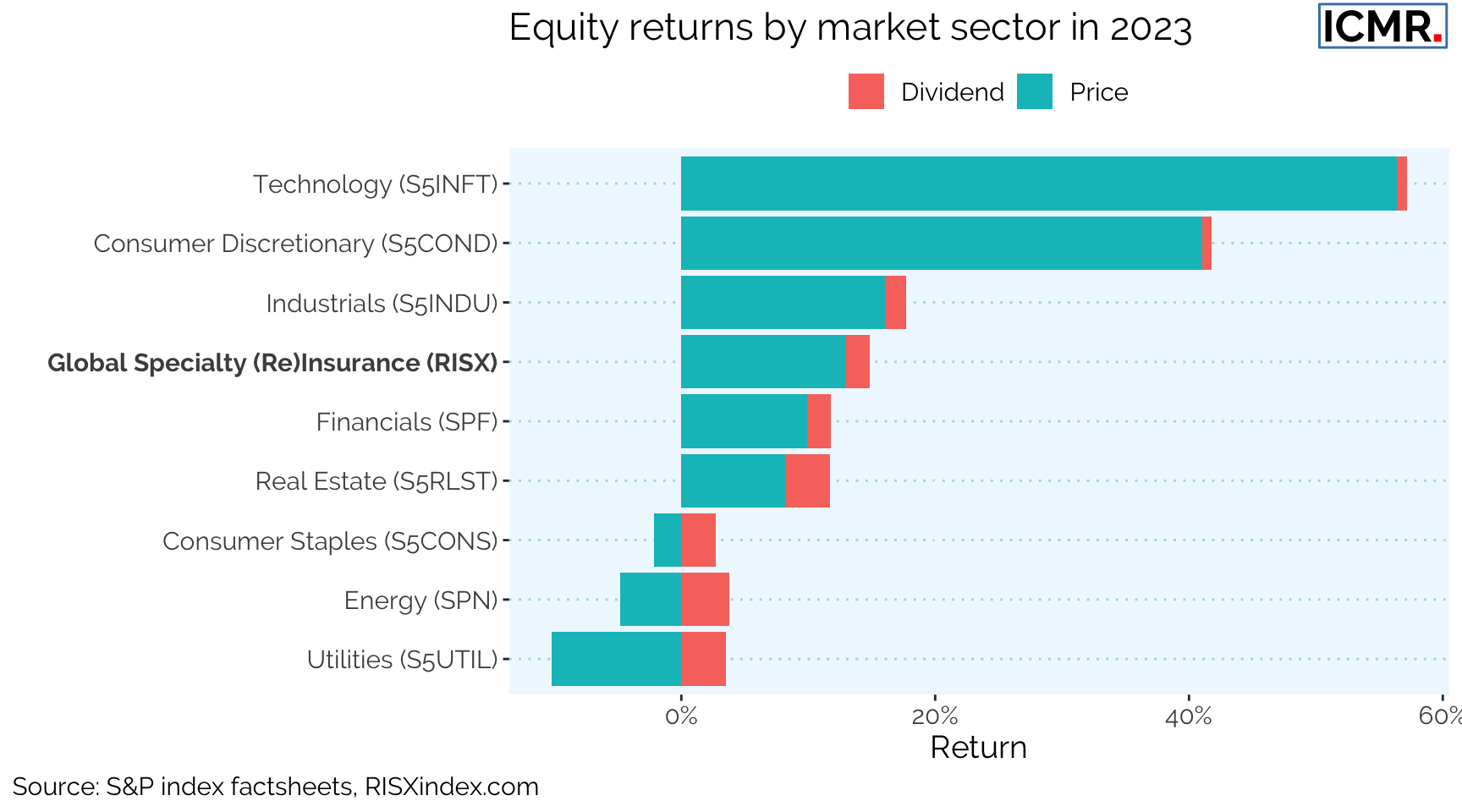

As a sector. Global specialty (re)insurance registered a favourable return in 2023, particularly when compared against the basket of broader investment market sectors.

The above chart shows the share price gain (or loss) over 2023 for the main sectors along with the RISX index which is an equity index based on the listed companies who own businesses in the Lloyd’s market and is premium weighted, not market capitalisation weighted. This weighting gives the index a risk profile which aligns as closely as possible to the Lloyd’s market itself. In this way, it provides a benchmark for investments within Lloyd’s.

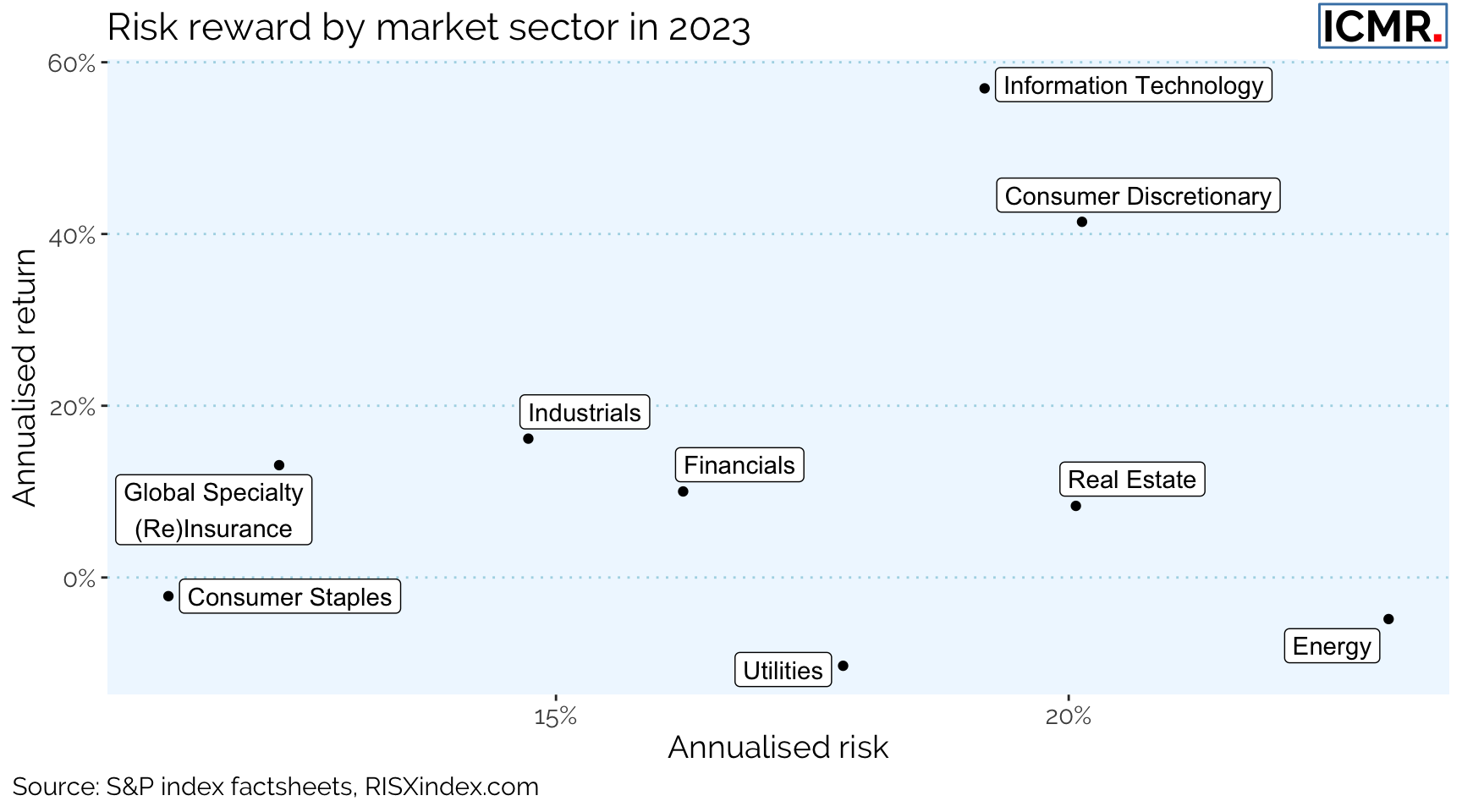

Reviewing the index composition in a little more detail shows the reward versus the risk underlying each sector. Whilst global specialty (re)insurance may only have generated the fourth largest mean return in 2023, it did so with a much lower risk (defined as the annualised risk from the daily volatility of capital markets pricing).

This won’t tell us much about the underlying insurance and reinsurance risks being underwritten, but it does suggest capital markets’ confidence in the sector. Despite the uncertainties facing the world during 2023 and into 2024, confidence in consistent returns from the sector appears steady. This is further reinforced by the sector, as proxied by the Global Specialty (Re)Insurance ‘RISX’ index data, having the lowest maximum drawdown of any of these sectors in 2023, which occurred around the collapse of SVB and Credit Suisse in March of last year:

| Global Specialty (Re)Insurance | Information Technology | Industrials | Consumer Staples | Consumer Discretionary | Financials | Energy | Utilities | Real Estate |

|---|---|---|---|---|---|---|---|---|

| 11% | 12% | 13% | 13% | 16% | 17% | 18% | 22% | 23% |

This would suggest that capital markets are perhaps starting to price in some of the underlying rate improvements sustained over the last few years, as well as the impact of higher risk free rates on the asset leverage specialty (re)insurers enjoy on their balance sheets. And this should augur well for any IPOs planned over the coming quarters.

This article was also published as a Viewpoint by The Insurer.