When Perfect is the enemy of Good

Is the difficulty in launching a new Lloyd’s fund down to focusing on the wrong aspect?

Lloyd’s offers a compelling investment proposition, with its potential for lower correlation with economic cycles and the opportunity for double use of assets. However, despite these advantages, new dedicated funds struggle to launch. Does the route to success need a different focus? This article argues that a wider investor mandate, with Lloyd’s as part of the strategy, might help to overcome some of the challenges of past attempts.

The Allure of Lloyd’s

The attractions of participation at Lloyd’s are well documented. Lloyd’s capital timetable itself is stable, well defined and necessary given the highly regulated nature of underwriting. Even London Bridge 2, with its segregated cell reinsurance structure, is there for further optionality. Yet still new dedicated funds struggle to launch and the idealised investment form the ‘Name of the future’ will take remains elusive, as also highlighted by a recent LMA/Aon report on this topic.

Lloyd’s, over the longer term, can be an attractive investment proposition for the right investors. The combination of lower correlation of underwriting returns with economic cycles combined with the double use of assets, particularly in the current premium rating and risk free rate climate, make for a compelling case.

Figure 1: Comparing Lloyd’s annual pro-forma returns on capital over 20 years against other investments. MSCI World is a market cap weighted equity of global stocks, RISX equity index data from 2007 onwards only.

The above chart shows the average Lloyd’s reported returns over the last 20 years, and compares them against a basket of liquid and illiquid alternatives. The bars in yellow show how returns have historically exhibited lower correlation with the wider economic markers, being highly correlated only with the Swiss Re Cat Bond index above, as one would expect.

The Misplaced Focus on Alpha

It is, perhaps, this aspect, on lower correlation, which gets lost in translation when prospective new Lloyd’s funds devise their strategies and prospectuses. Of course every investor likes the idea of superior alpha, but that simply isn’t always available, and certainly not immediately and at scale.

The Power of Lower Correlation

Is it not more the case that the likely investors in such funds (whether HNW, UHNW or institutional) find a key attraction in the lower correlation more than immediate alpha at scale? That a tracker fund is much more likely to achieve scale quickly than a superior alpha fund? And that deploying funds raised across a range of our industry’s lower correlating assets will still deliver the necessary returns whilst overcoming the deployment conundrum where opportunities with Lloyd’s syndicates may simply not be there?

A Balanced Approach: The Barbell Strategy

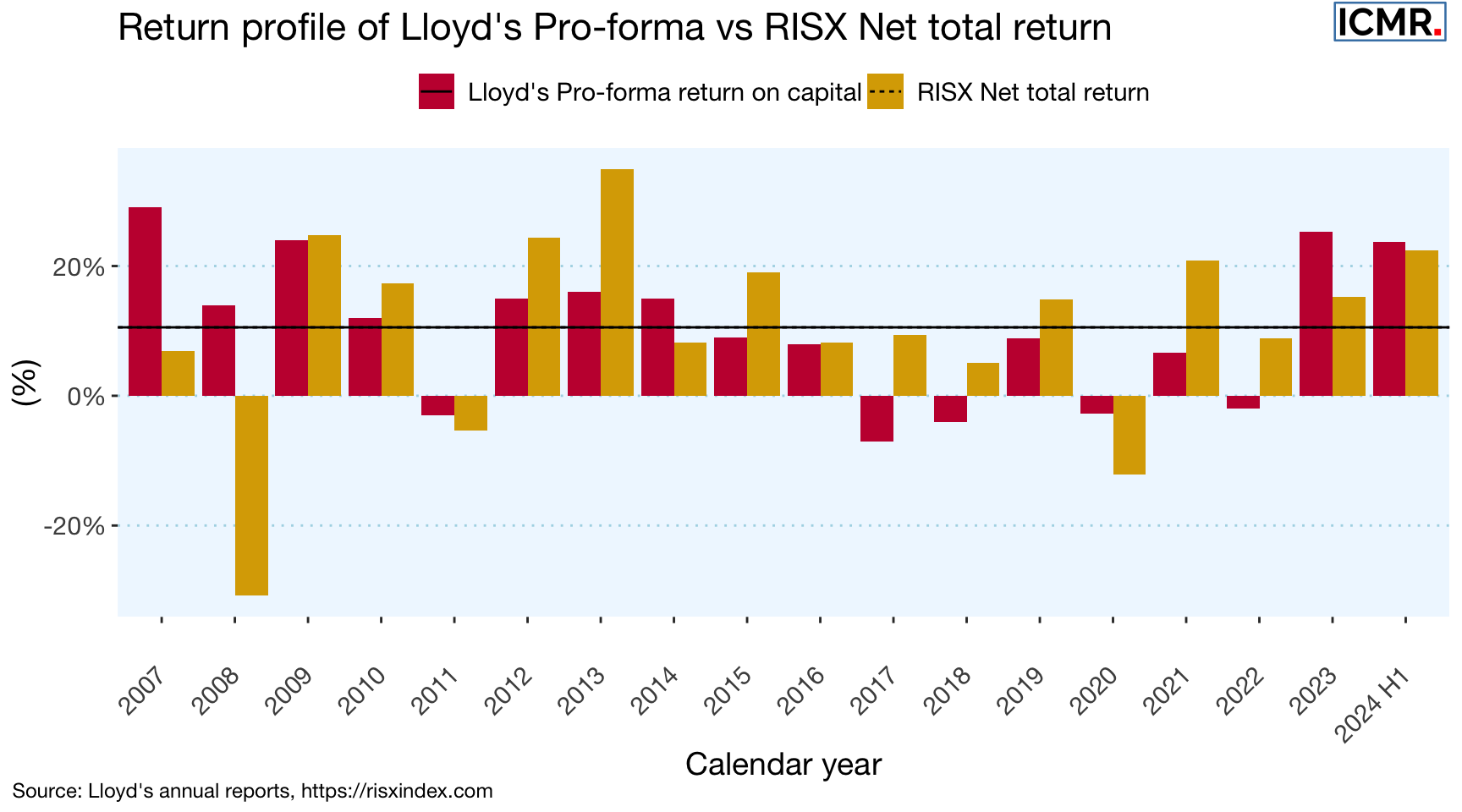

The chart below expands on the previous chart, comparing Lloyd’s average returns against the RISX equity index of listed global (re)insurers with Lloyd’s managing agency subsidiaries (horizontal lines). The long term returns are incredibly similar, as would be expected given inter-platform syndication of risk and similar regulatory frameworks.

Figure 2: Comparing Lloyd's pro-forma returns with stock returns, including dividends, as measured by the RISX equity index of publicly listed companies with Lloyd's subsidiaries, see also www.risxindex.com

So, in the longer term, a tracker fund would be less concerned about the split between assets and more concerned about maximising deployment.

The Importance of Realistic Expectations

A barbell approach to deploying funds raised between syndicates and more liquid alternatives with similar return characteristics, combined with a focus on lower correlation rather than illusory superior alpha, might encourage investors to take the leap. Ultimately it will come down to the investment mandate the new funds’ strategies seek from those.

This article was also published as a Viewpoint by The Insurer.