ICMR suggests a sub-90% combined ratio for Lloyd’s based on ‘RISX’

Using the reported data of the RISX index constituents ICMR forecasts Lloyd’s will continue outstanding performance

Early indications suggest Lloyd’s of London is poised for another impressive year, as ICMR forecasts a combined ratio well below 90% (84% in 2023), despite significant catastrophe activity in 2024. This projection is based on the reported results of 21 out of 27 listed companies with ownership of Lloyd’s businesses, comprising the RISX equity index, which provides a valuable snapshot of the market’s performance.

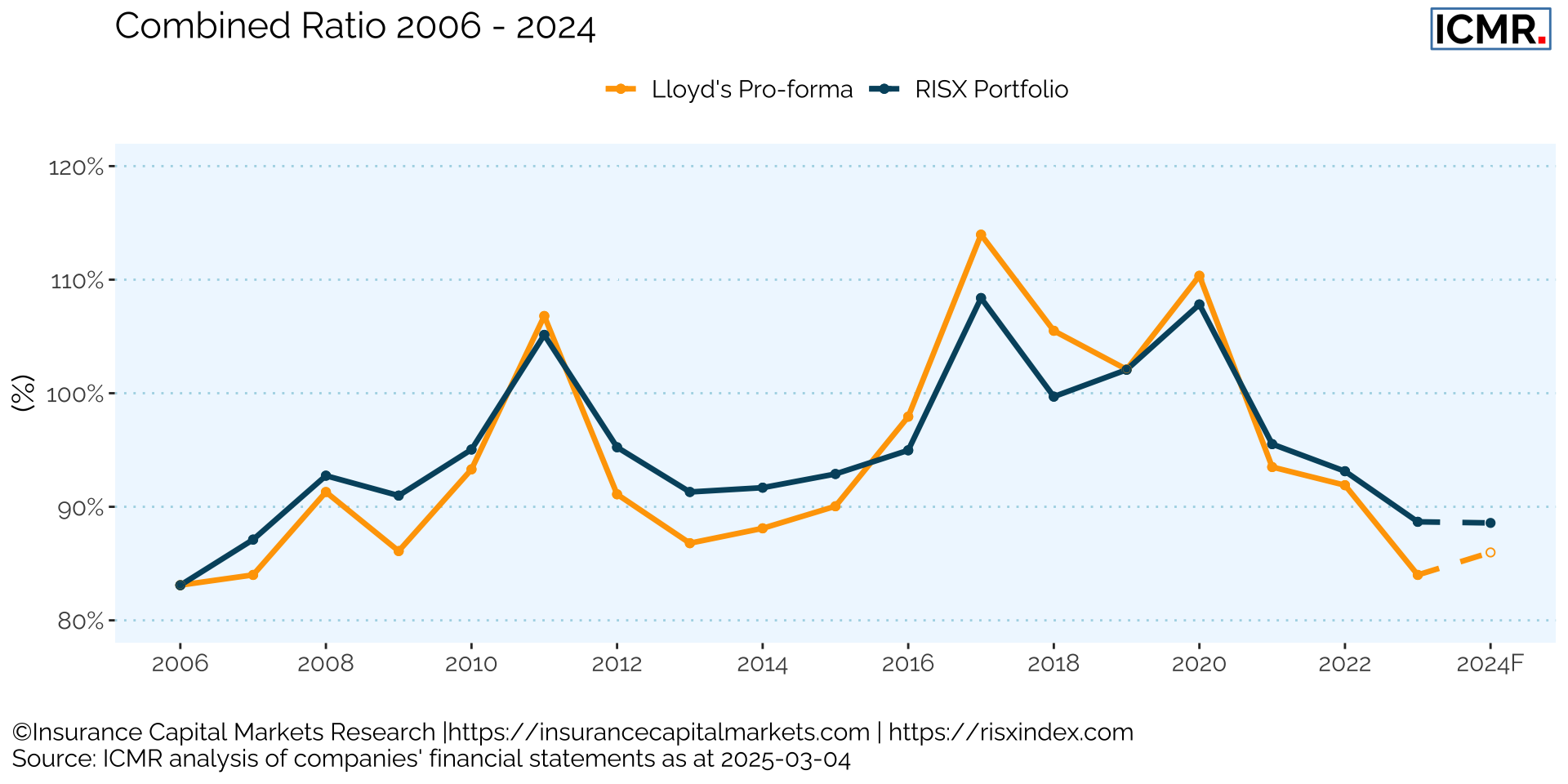

Figure 1: Lloyd's 2024 pro-forma predicted combined ratio based on reported combined ratios on 21 out of 27 listed parent companies that control Lloyd's businesses

As Figure 1 demonstrates, ICMR expects Lloyd’s to outperform the aggregate performance of its parent companies, highlighting the value proposition of the Lloyd’s platform.

For the first half of 2024 Lloyd’s reported a combined ratio of 83.7%, following the events in the second half of the year a small deterioration is expected, but Lloyd’s should report a combined ratio very comfortably below 90%, as have 9 out of 22 RISX constituents that have reported their 2024 results to date.

The chart shows the RISX equity index is not merely a good benchmark for investing at Lloyd’s; it is also a leading indicator of Lloyd’s pro-forma annual accounting performance. This gives pundits and observers a head start on the likely Lloyd’s numbers yet to be reported.

Equity investors in the sector also enjoyed a very successful year, as evidenced by the RISX equity index. Investing in the shares of Lloyd’s parent companies, proportionate to their Lloyd’s involvement, would have yielded a total net return of 31.8% for the calendar year.

Further analysis will be possible once Lloyd’s releases its full 2024 results later in March. However, the continuing trend of much-improved underwriting performance in recent years and another year with strong returns on capital, should also suggest a continued investor interest in deploying capital in the sector in general and at Lloyd’s in particular.

For more information about RISX equity index, its constituents and performance, including factsheet, visit risxindex.com.

This article was also published as a Viewpoint by The Insurer.