About Insurance Capital Markets Research

Bridging two industries that, despite their physical proximity, feel worlds apart

Insurance Capital Markets Research (ICMR), a quantitative analysis specialist for the (re)insurance and capital markets industries, was founded by a team with over 20 years of experience working in both sectors. The company’s founders believe that the two industries are more closely aligned than they appear, and that bridging the gap between them can lead to significant benefits for both sides.

The founders learned their most important lesson at Lehman Brothers in 2008: “You make money until you don’t.” However, the most revealing impression was how those two industries that work in such close proximity in their day to day business, e.g. most loans require insurance security, have been divided by their languages.

This becomes most apparent at crossover points such as capital raising or ILS. Not surprisingly misunderstandings can and do arise as the same label can have a different meaning depending on the industry. The concept of premium, which seems clear to every investor, can be a lot more complex for an insurer, particularly in Lloyd’s where there are so many different nomenclatures and accounting principles for premiums. The table below lists just some of the more common vocabulary:

| (Re)insurer | Investment bank/ Capital market |

|---|---|

| Cedent | Sponsor |

| Reinsurer | SPV, SPI |

| Rate on Line | Coupon, Spread |

| Risk period | Tenor |

| Reinsurance structure | Waterfall |

| Capacity | Assets under management (AUM) |

| Capital | Collateral, Principal |

Both markets deal with uncertainty and risk, but with different labels and therefore perceptions of that risk. It is much easier to sell a loan or mortgage where the client receives the money, than an insurance policy where premiums have to be paid upfront for a future “promise to pay”.

Comparing the two industries by their sizes provides not only a view on the difference in scale, but also a sense of the insurance gap, since premium income (which is of comparable scale to policyholder surplus) represents around 2.5% of GDP but only about 1% of capital markets.

| Industry | Size |

|---|---|

| Non-life reinsurance gross premium | c.$200bn |

| Lloyd’s gross premium | c.$45bn |

| Direct non-life insurance gross premium | c.$2trn |

| World wide non-life (re)insurance gross premium | c.$2.2trn |

| Equities market cap | c.$85tn |

| Fixed income securities outstanding | c.$100trn |

| Capital markets | c.$185trn |

Over the last 10 years, the rapid rise of direct capital markets investment in insurance risk, principally through ILS and collateralised reinsurance, have slowly started bringing about convergence between the markets, but material differences persist. The differences between a reinsurance contract wording and a bond contract remain markedly different, in part driven by the lack of legal precedent with the latter and therefore the lack of standardised clauses. It is not for no reason that the largest transaction fees tend to be the lawyers’!

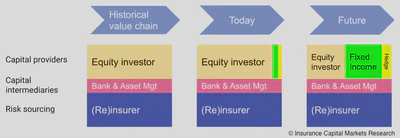

ICMR believe that there will be an evolution of insurance risk capitalisation. Where in the past most of the capital was equity from shareholders or members in the case of mutuals or Lloyd’s syndicates, we will see the fixed income market participate to a much greater extent in capitalising risk, making insurance more capital efficient.

ICMR was created to bridge some of these gaps and, hopefully, to help broaden understanding between the two markets of each others drivers and issues.